You are browsing corvette7

|

|

#1 | ||||

Drives: 2010 Kona Blue GT500 Join Date: Mar 2010

Location: Texas

Posts: 540

|

OK, someone posted a link to an article which ridiculed GM for manufacturing a $30B asset. I thought I would give the forum a little perspective because I know many of you may be considering investing in GM when it goes public.

This is not meant to start a debate of GM vs. Ford vs. Chrysler vs. Nissan or whatever other crap that might come up. This is simply an explanation for how the accounting works because I have the knowledge to explain it. Keep it clean. Quoted Original Article (Link below): Quote:

Quote:

This guy clearly isn’t a CPA, he is an analyst who is getting all hot and bothered by GM. This kind of stuff happens when company’s exit bankruptcy and want to reflect their financial position with more accuracy. http://www.bloomberg.com/news/2010-0...than-weil.html Quote:

Quote:

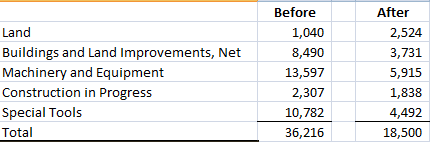

http://www.deloitte.com/view/en_US/u...42f00aRCRD.htm ASC stands for the Accounting Standards Codification. It basically is our accounting rule book. It is where every standard for the treatment of transactions and events for financial reporting hides. There are other statements issued by the SEC but that isn’t what is being dealt with here. The basic issue at hand is that GM went into bankrutpcy with $X in assets, $X in liabilities and the remainder was shareholder’s equity. When they exited bankruptcy, as a part of their restructuring, they were allowed to revalue everything. Let’s also back up and revisit some facts. As a part of bankruptcy reorganization GM (the original) became Motors Liquidation Co. (“Old GM") and GM (“New GM”) was reborn using the same name. As a part of that legal reorganization all of the equity in Old GM got wiped out because the entity went defunct. Meaning that your basic accounting equation (Assets = Liabilities + Shareholder’s Equity) is now out of whack because the equity side got chopped but the asset side didn’t budget. On that same day, as a part of this reorganization New GM revalued the assets and liabilites sides of the equation as well. So now you have all three parts moving at once. Equity, we can nail that number down. New GM knows what the company received when they issued stock to the current owners of New GM (Treasury, UAW, Canada, etc.). The liability numbers, in general, are determinable for most companies. The problem New GM has is the insane pension liabilities related to the union workers. Given GM’s horrid credit quality they had to use very high discount rate (a.k.a. interest rate to determine the present value of a future liability). So now you’ve got your liabilities moving down. At this point you have GM’s equity going from a deficiet (e.g. negative equity) of $109.4B to a positive of $19.2B for a swing of $128.6B. Liabilities have gone from $213.7B to $121B or a decrease of $92.7B. Mathematically the right side of the accounting equation has now increased by $35.9B which means, regardless of what the value of the assets are before the switch they will increase by $35.9B because the equation must balance. Related to the assets there were 2 major changes: Property, Plant and Equipment and Intangible Assets.  As you can see from the summary above the biggest changes were in buildings, machinery and special tools. None of these should really be a surprise to anyone. GM was a very bloated organization with nearly a dozen brands and the factory capacity to match. When the economy went south and GM decided to spin off brands they couldn’t sell everything. GM was left with some brands which they didn’t want and couldn’t sell. So what was the result? Just stop making the cars. As the economy struggles to rebound it is nearly impossible for GM to sell the specialized tools, plants and even the property. In accounting when you revalue an asset like this you have to bring it to the value you would expect to sell it for in a normal orderly transaction (a.k.a. not a fire sale). I would expect buildings, highly specialized assembly plants, real estate, etc. to take a huge hit. Housing market has busted, no one is laying out cash for things like full assembly plants, commercial real estate is in the toilet, contractors are defaulting on loans left and right. A decrease of 50% seems reasonable because when the assets were put in place their value was spread out over the course of their estimated life which probably extended another 10-15 years and accordingly their depreciation didn’t track with the value of the assets as they stand today. It’s one of those best guess games that we accountants have to play. The other change was an $15.9B increase to intangible assets. Intangible assets include things like patents, copyrights, customer relationships, dealer networks, non-compete agreements with former executives, etc. All of these things have value. From an accounting perspective things that are created internally (i.e. Pontiac logo, Chevy logo if they weren’t purchased) can only be capitalized (i.e. put on the balance sheet) at the cost that it took to create them. You are not allowed to put the value of them on the balance sheet unless you can measure them at fair value which is what bankruptcy allowed GM to do and hence the significant increase in intangibles. So now we’ve basically got a wash here. Fixed assets are down by $17.7B and intangibles are up by $15.9B for a net change of $1.8B. There were other minor adjustments to the assets but the largest two (excluding Goodwill) washed out. So the right side has gone up by almost $36B but the left side has remained flat. Mathematically it has to balance so the accounting rules say shove the value into this thing called “Goodwill”. As noted by other members, Goodwill typically arises when a company pays more for a company than the net assets are worth (assets minus liabilities). It is possible to have negative goodwill but that’s for another day. However this is an oddball circumstance whereby a company can write on an asset which really doesn’t have a basis other than making the math work Now, going forward you will see this Goodwill be written off. Annually, GM will have to evaluate the discounted cash flows and compare them to their public float (equity + debt). If the discounted cash flows are less than the float then you will see what is called a Goodwill impairment charge which is a fancy term for bringing down the value of Goodwill so that discounted cash flows exceed their public float. It is a non-cash charge that has no impact on anything. It’s all on paper. No analyst cares about it, no investor should care about it. There are some theoretical implications based on the impairment charge but the bottom line is it will not affect the entity’s ability to make money or their associated cash flows normally. So let’s all just chill out and take a deep breath. Numbers sources: http://www.sec.gov/Archives/edgar/da...htm#rom45833_7 http://www.sec.gov/Archives/edgar/da...tm#toc85733_13

__________________

CERTIFIED PUBLIC ACCOUNTANT [TEXAS] You've been Thread Jacked by SF03! Current Car: 2010 Kona Blue Shelby GT500 M6 Previous Car: 2010 Black Camaro 2SS/RS M6 Two Back: 2007 Black Shelby GT500 M6 |

||||

|

|

|

|

|

#2 |

Drives: fanboys and ass kissers crazy. Join Date: May 2008

Location: Ottawa, Ontario

Posts: 7,275

|

A guy walks into an accounting firm looking for a new accountant for his business. He goes to the first firm and meets with the senior partner and says "I've got one question for you - how much is 1 + 1?" The partner looks back at him oddly and says "2". The potential customer gets up and walks out the door.

He goes to another firm and asks the same thing - "How much is 1 +1?" The guy stares at him in disbelief and after a few seconds of silence, says "2". Again the business man shakes his head and walks out. Finally he walks into the last accounting firm and demands to see the most senior partner. He is brought up to mahogany row and is presented to the senior partner. The business man sits down opposite the senior partner and says "I am having a really hard time finding a firm that I can have complete confidence in with respect to my business. I only have one simple question for you. How much is 1 + 1?" The senior partner gives him a real solid stare, gets up from the table and closes the door. He then returns to the businessman and says "How much do you want it to be?"

__________________

"BBOMG - More than just a car show.... It's an experience!"

Last edited by Hylton; 09-09-2010 at 07:29 PM. |

|

|

|

|

|

#3 | |

Drives: 2010 Kona Blue GT500 Join Date: Mar 2010

Location: Texas

Posts: 540

|

Quote:

__________________

CERTIFIED PUBLIC ACCOUNTANT [TEXAS] You've been Thread Jacked by SF03! Current Car: 2010 Kona Blue Shelby GT500 M6 Previous Car: 2010 Black Camaro 2SS/RS M6 Two Back: 2007 Black Shelby GT500 M6 |

|

|

|

|

|

|

#4 |

Drives: fanboys and ass kissers crazy. Join Date: May 2008

Location: Ottawa, Ontario

Posts: 7,275

|

I thought you'ld like that. Most of my close friends are accountants for some strange reason.

__________________

"BBOMG - More than just a car show.... It's an experience!"

|

|

|

|

|

|

#5 |

|

Nice explanation.

|

|

|

|

|

|

#6 |

Drives: 2010 Kona Blue GT500 Join Date: Mar 2010

Location: Texas

Posts: 540

|

Thank you.

Tried to keep it simple and straight forward for those looking at investing in GM. Note: This isn't investment advice... just making sense of the jargon. (CYA baby.... CYA).

__________________

CERTIFIED PUBLIC ACCOUNTANT [TEXAS] You've been Thread Jacked by SF03! Current Car: 2010 Kona Blue Shelby GT500 M6 Previous Car: 2010 Black Camaro 2SS/RS M6 Two Back: 2007 Black Shelby GT500 M6 |

|

|

|

|

|

#7 |

Drives: 2010 Camaro LS-M6 67 Chevelle Wgn Join Date: May 2009

Location: .

Posts: 1,509

|

I remember this guy (Jonathan Weil) from another forum I use to belong to. The discussion at the time (last year) in that forum was bank failure`s and the FDIC and someone posted an article by him, which at the time didn`t seem to jive with my understanding of the FDIC, then another member posted this rebuttal to that argument. http://curiouscapitalist.blogs.time....ding-the-fdic/

It would seem that Jonathan Weil not only isn`t a CPA, he also dosn`t understand how the FDIC is run. |

|

|

|

|

|

#8 |

|

I used to be Dragoneye...

|

Thank you for taking the time to write that out, SuperFly.

There are a few terms up there that I don't fully understand (not an accountant, remember...  ). But it was very informative, and cleared up a lot of misinformation. ). But it was very informative, and cleared up a lot of misinformation.Thanks, again!!

|

|

|

|

|

|

#9 | |

Drives: 2010 Kona Blue GT500 Join Date: Mar 2010

Location: Texas

Posts: 540

|

Quote:

If you need additional clarification please let me know. I'd be more than happy to expand the discussion.

__________________

CERTIFIED PUBLIC ACCOUNTANT [TEXAS] You've been Thread Jacked by SF03! Current Car: 2010 Kona Blue Shelby GT500 M6 Previous Car: 2010 Black Camaro 2SS/RS M6 Two Back: 2007 Black Shelby GT500 M6 |

|

|

|

|

|

|

#10 |

Drives: GTI Join Date: Jun 2010

Location: Don't worry bout it

Posts: 328

|

I don't know enough about accounting to fully understand whether you're right or not, so I'll take your word for it until I hear a good counter-argument. Until then, let's hypothetically say you're definitely right, even then why would somebody then want to invest in GM?

|

|

|

|

|

|

#11 |

|

General Motors Aficionado

Drives: 2023 GMC Canyon, 2023 Expedition Join Date: Aug 2008

Location: Florida

Posts: 37,375

|

:troll:

__________________

2023 GMC Canyon Elevation 2023 Ford Expedition SSV (State-Issued) |

|

|

|

|

|

#12 |

Drives: 2010 Kona Blue GT500 Join Date: Mar 2010

Location: Texas

Posts: 540

|

__________________

CERTIFIED PUBLIC ACCOUNTANT [TEXAS] You've been Thread Jacked by SF03! Current Car: 2010 Kona Blue Shelby GT500 M6 Previous Car: 2010 Black Camaro 2SS/RS M6 Two Back: 2007 Black Shelby GT500 M6 |

|

|

|

|

|

#13 | |

|

Moderator.ca

|

Quote:

__________________

Note, if I've gotten any facts wrong in the above, just ignore any points I made with them

__________________ Originally Posted by FbodFather My sister's dentist's brother's cousin's housekeeper's dog-breeder's nephew sells coffee filters to the company that provides coffee to General Motors...... ........and HE WOULD KNOW!!!!__________________ Camaro Fest sub-forum |

|

|

|

|

|

|

#14 |

Drives: GTI Join Date: Jun 2010

Location: Don't worry bout it

Posts: 328

|

|

|

|

|

|

|

|

Similar Threads

Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| 14 Worries about GM's IPO | All-Or-Nothing | General Automotive + Other Cars Discussion | 1 | 08-18-2010 01:39 AM |

| Not Good, GM wants another 16 or is it 9 Billion to Survive. | Scott@Bjorn3D | General Automotive + Other Cars Discussion | 226 | 02-20-2009 05:13 PM |

| GMS Pricing..Someone please define. | Banshee | 5th Gen Camaro SS LS LT General Discussions | 4 | 02-03-2009 11:46 PM |